Index Trend & Conditions – 07:00 a.m. I.S.T.

• Resistance for Nifty 50 is seen at 14,280 14,435 — 14,465 and 14,590. For Wednesday, Jan 27, Support area is seen at 14,190 (small) and 14,125 (major)

• Support levels for Bank Nifty are at 30,870 — 30,750 and 30,275 with Resistance at 31,535 31,775 and 32,600

• The MSCI Asia Pacific ex-Japan is trading higher 0.32%, and the MSCI Emerging Market index is up 0.40%

• Trends on SGX Nifty looked primed for a muted start for Nifty 50 in India. The Nifty futures are trading 108 points, or 0.77% higher at 14,191 on the Singaporean Exchange at 07:15 a.m. I.S.T.

• U.S. equity futures increased in early morning trade with Nasdaq, S&P 500 and Dow Jones futures trading in green, alongside a mostly positive start to Asia-Pacific early Wednesday trade with stocks climbing in Japan, Hong Kong, South Korea, China and slipping in Australia; a positive MSCI Asia-Pacific ex-Japan index; U.S. Dollar holding declines at 90.16 with 10-Year Treasury Yield rising to 1.04 and Gold futures retreating to $1,848 on the day indicate a stable-to-positive outlook for Nifty 50 India

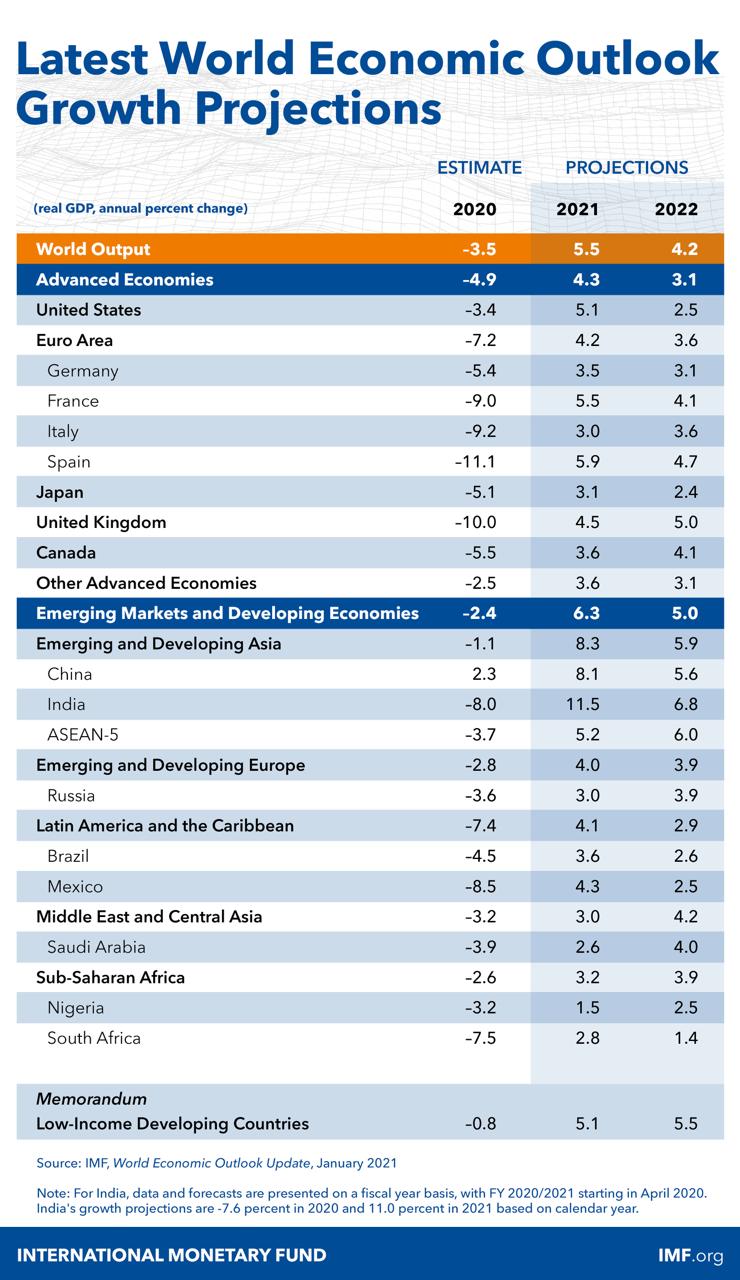

• IMF in its latest update on World Economic Outlook on Tuesday is forecasting the global economy to grow by 5.5% this year, up 0.3% on its forecasts made last year, which is an improvement due to innoculation drives and and financial support packages deployed by governments

India Markets

India’s equity benchmarks were closed on Tuesday trade, on account of Republic Day celebration

Yield on the benchmark 10-year government bond increased to 5.97%, while the rupee appreciated to 72.8990 per U.S. dollar

India’s federal budget presentation is due on February 1

International Monetary Fund in their latest January 2021 update on World Economic Outlook projects 11.5% growth rate for India in Fiscal year 2021-22. The agency also expects global trade to rebound this year: recording 8.1% growth after falling -9.6% last year

America Markets

U.S. stocks slipped and gave up modest early gains on Tuesday trade, a day after major indexes hit records and as investors readied for a slew of blue-chip earnings

The broad-based S&P 500 fell 5 points, or -0.2%, to 3,849

The Dow Jones Industrial Average, composed mostly of cyclical stocks, fell about 23 points, or -0.1%, to 30,937

The tech-heavy Nasdaq Composite Index edged down 9 points, or -0.1%, to 13,626

U.S. equity futures increased slightly in early Wednesday trade. S&P500 futures is up 0.10%; Dow Jones futures is up 0.01% and Nasdaq futures is up 0.53%

10-year U.S. Treasury yields held earlier losses at 1.04% on the day as dollar held declines at 90.16

The Cboe Volatility Index, known as Wall Street’s “fear gauge,” fell -0.73% to 23.02 on Tuesday

The U.S. Federal Reserve is due to announce results of its two-day policy meeting on Wednesday. Analysts expect the Fed to stick to its dovish tone to help speed the economic recovery

The Conference Board released its index Tuesday of consumer confidence, which showed U.S. consumers’ outlook on the economy improved in January. Consumer confidence increased to 89.3 in January from 87.1 in December

U.S. home-price growth continued to accelerate toward the end of 2020. In the year to November, the S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas, rose 9.5%

Fourth-quarter GDP, initial jobless claims and new home sales to release on Thursday

U.S. personal income, spending and pending home sales are to come on Friday

“What’s working in the market’s favor is the overall trend of economic growth is still robust and that’s likely to translate to positive earnings,” said Shoqat Bunglawala, head of multiasset solutions, international, at Goldman Sachs Asset Management. “There’s an expectation that there’s going to be more robust growth driven by pent up demand in the second half of the year.”

Asia-Pacific Markets

Asian benchmark stocks looked set to recover in early Wednesday trade, bouncing back from a steep sell-off on Tuesday, as investors mulled a slew of earnings reports amid worries over virus variants and hurdles to stimulus

Stocks climbed in Japan, Hong Kong, South Korea, China and slipped in Australia, which opened after a Tuesday holiday

Japan’s Nikkei 225 added 0.53% to 28,699 and Topix 500 added 0.58% to 1,447

South Korea’s Kospi added 0.92% to 3,169

In Hong Kong, Hang Seng added 0.41% to 29,506 while Hang Seng China Enterprises added 0.49% to 11,750

In China, CSI 300 dropped -0.13% to 5,505 and Shanghai Composite added 0.11% to 3,573

Australia’s S&P/ASX 200 dropped -0.76% to 6,772

Overall, MSCI Asia-Pacific, is down -1.28%

Hang Seng along with other Asian stocks markets took a dive on Tuesday after People’s Bank of China withdrew 78 billion yuan, or the equivalent of $12 billion, from the Chinese financial system through open-market operations and an official cautioned about asset bubbles

The decision was as it went against recent reports in Chinese newspapers that liquidity wouldn’t be tightened before the lunar holidays. It is said that risks of asset bubbles will remain in the stock or property market as long as China doesn’t shift its focus toward job growth and inflation management.

As per PBOC Governor Yi Gang, China is seen to support economic growth while limiting risks to the financial system and hence wants to bring investors out of the euphoria caused by abundant liquidity in December. Yi also added that China’s total debt-to-output ratio climbed to around 280% at the end of last year

EU Markets

European equities rebounded and were almost uniformly green on Tuesday trade, as strong earnings reports and brighter global economic outlook from IMF overshadowed concerns related to the coronavirus pandemic and AstraZeneca delivery delays

Gains in financial services and chemical sectors helped European stocks rally on Tuesday

The pan-European Stoxx Europe 600 added 0.77% to 406 and Stoxx 50 also added 1.12% to close at 3,592

Germany’s DAX30 added 1.66% to 13,870

London’s blue-chip FTSE 100 added 0.23% to 6,654

France’s CAC40 added 0.93% to 5,523

Denmark’s OMX Copenhagen 20 dropped -1.03% to 1,474

Spain’s IBEX 35 added 0.86% to 7,694

Italy’s FTSE MIB added 1.15% to 21,987

Naturgy Energy Group SA soared 15% as asset manager IFM Global Infrastructure offered to buy a stake in the Spanish utility

Sweden’s EQT AB, one of Europe’s biggest private equity firms, jumped 15% after agreeing to take over Exeter Property Group in a $1.9 billion deal

Shares of UBS Group rose 3.1% after the Swiss bank announced a new buyback program of up to $4.5 billion, having closed 2020 with a consensus-beating quarterly performance

The unemployment rate in the UK edged up to 5% in the three months to November of 2020 from 4.9% in the previous period and slightly below forecasts of 5.1%

“The numbers that are coming out show economic activity in Europe is falling back and underperforming other parts of the world,” said David Miller, investment director at Quilter Cheviot. “So far, investors are prepared to look through the current difficulties on the basis that second half will be better.”

Oil & Natural Gas Markets

Crude-oil fluctuated between small gains and losses in early Wednesday trade, with hiccups in the Covid-19 vaccine rollout signaling a further hit to demand

Supporting prices are the voluntary production cuts by Iraq, as part of OPEC’s strategy to keep crude futures elevated

WTI Crude is trading at $52.69 per barrel

Brent Crude is trading at $55.98 per barrel

Natural Gas futures is trading higher at $2.645/MMBtu

On MCX-India, Crude oil futures is steady at 3,837 on Monday trade

On MCX-India, Natural gas futures rose to 185/MMBtu on Monday trade

“The physical market appears to be absorbing any material demand softness from lockdowns in stride, for now,” RBC analysts wrote in the report. “However, the physical market is far from tight and additional barrels are not being bid in size, even as the Saudi cut propagates to the consumer base for next month.”

Commodities Markets

Gold futures retreated in early Wednesday trade

U.S. Gold futures (Comex) is trading lower at $1,848 an ounce

Silver futures (Comex) is trading higher at $25.42 an ounce

Copper futures (Comex) is trading steady at $3.6195 per pound

SGX Iron-Ore futures is trading lower at $168.65 per tonne

In India, Spot Gold is trading at INR 48,137 per 10 grams

Currency Markets

The U.S. dollar index, DXY held declines against riskier currencies at 90.160 in early Wednesday trade, as markets wait on comments from Federal Reserve Chair Jerome Powell, who is likely to renew a commitment to ultra-easy policy

INR strengthened with USD / INR at 72.8990

JPY strengthened with USD / JPY at 103.6800

CNY strengthened with USD / CNY at 6.4652

EUR strengthened with EUR / USD at 1.2158

GBP strengthened with EUR / GBP at 0.8858

GBP strengthened with GBP / USD at 1.3276

| 3-Month LIBOR Rate | As on 26 Jan 2021 |

| US DOLLAR | 0.22 per cent |

| Euro | – 0.55 per cent |

| British Pound | 0.04 per cent |

| Swiss Franc | – 0.76 per cent |

| Japanese Yen | – 0.07 per cent |

Bitcoin

Bitcoin / U.S. Dollar fell -0.76% in early Wednesday trade to $32,005 as of 07:30 a.m. I.S.T.

The world’s largest cryptocurrency has been trending downward since peaking around $42,000 earlier this month. The coin fell as much as 5.7% Tuesday, dropping below $31,000, and testing its 50-day moving average

“If Bitcoin breaks below and then stays below the 50-day moving average, it should serve as confirmation that the move over the past four months was a speculative blow-off top,” said Michael O’Rourke, chief market strategist at JonesTrading.

Bond Markets

Americas : 10 – Year Govt Bond Yields

United States : 1.04%

Canada : 0.82%

Europe, Middle East & Africa : 10 – Year Govt Bond Yields

Germany : -0.53%

United Kingdom : 0.27%

France : -0.30%

Italy : 0.64%

Netherlands : -0.47%

Asia Pacific : 10 – Year Govt Bond Yields

India : 5.97%

Japan : 0.02%

Australia : 1.11%

Hong Kong : 0.47%

Singapore : 0.98%

South Korea : 1.77%

Fund Flows on NSE, BSE and MSEI — 26 Jan 2021

Indian equity markets were closed for a holiday on account of Republic Day celebration

Where We’ve Been Reading —

- Bloomberg

- Trading Economics

- Reuters India

- Financial Times

- NSE Indices India

- NCDEX (National Commodity & Derivatives Exchange Ltd.)

- Morningstar India

- The Wall Street Journal

- Tech Crunch

- The Star

- The Washington Post

- Harvard Business Review

- Business Standard

- The Economic Times